It has been little over a decade since Marc Andreesson made the famous statement “Software is now eating the world”. Cloud and mobile based software services have since added $17 Tn in NASDAQ. In addition, more than 1500 unicorns have been created in the last decade, nearly all of them either provide software based products/services (AI, SaaS, Enterprise software, cybersecurity) or powered by software (e-commerce, Fintech, HRTech, marketplaces). While software is likely to remain a powerhouse of value creation, the next wave of profoundly radical ideas is expected to come largely from the innovations at the intersection of bits, atoms and genes, and that is what we defined as DeepTech in our analysis.

If we look closely for the emerging trend, 50 unicorns have already come from DeepTech ideas (Multi-omics analysis, Space Tech, Electric Vehicles, Alt-protein, Alt-energy, Biomaterials, Quantum computing etc), where there were only two of these five years ago.

Impact lens:

These DeepTech startups don’t promise to just improve the customer experience or bring efficiencies to the supply chain, they hold promise to solve large problems faced by humanity by working on breakthroughs that were erstwhile considered impossible. In 2022 alone, we have seen four very promising advancements:

- Understanding Protein structures is a critical piece of solving the puzzle of various diseases and how to develop therapies effective to solve them. Out of 200 million known proteins, existing technologies could have us identify less than 200 thousand proteins over 60 years. On July 28, 2022, DeepMind team uploaded to the database the highly accurate structure predictions of around 200 million proteins from 1 million species, covering nearly every known protein on the planet. They took only 6 years to get there. That is 1000x improvement in 1/10th the time.

- OpenAI GPT-3 can now write original prose with the fluency of a human, and its machine-generated content is now indistinguishable from human-generated content. It has been trained on 175 billion parameters (requiring 800 GB of storage).

- Cas9, the gene editing technology that has been showing promise towards biotech research and product development, is showing promise to cure rare genetic disorders like sickle cell anemia and beta thalassemia that have been considered untreatable for the entire history of humanity so far.

- We have had a theoretical understanding of fusion for over a century. But this year, for the first time ever, a team at Lawrence Livermore National Laboratory’s National Ignition Facility (NIF) conducted the controlled fusion experiment to achieve fusion ignition, also known as scientific energy breakeven, meaning it produced more energy from fusion than the laser energy used to drive it.

When innovations like these succeed, they hold the promise to shift the entire industry, and sometimes multiple industries, through their offerings. And the coming decade is going to belong to radical innovations like these.

Venture investing lens:

Venture investment for tech enabled business model innovations has matured greatly with many templates and frameworks for evaluating what ideas are likely to work. No wonder, most of VC funding goes towards ideas like marketplaces, mobile apps, and to some extent, AI models are enabled by technology. These ideas carry minimal technology risk and execution is often a function of talent and capital.

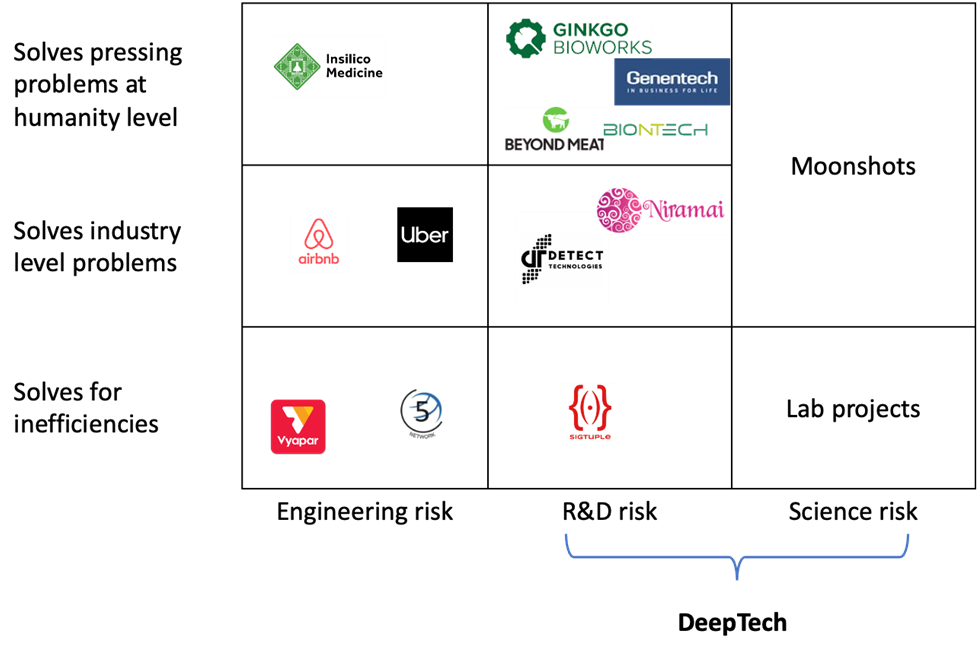

Deeptech investing still remains a field that requires evaluation of market risk coupled with risk of technological innovation succeeding. Technological innovation by itself is a term that covers a wide spectrum of ideas, carrying minimal and predictable to unfathomable risks. When VCs look at these ideas from the perspective of making investment decisions, they look at a spectrum of risk that comes with it. It can range from Engineering risk (Can it be done at such a large scale? Short time? With such a large dataset?), to R&D risk (Typically transdisciplinary, with some element of fundamental science at an advanced, translational stage), to Science risk (Can we bend the rules of fundamental science as we know it today?).

While DeepTech investing gets defined differently by different stakeholders, we would like to think of DeepTech investing as taking this R&D risk to support ideas that hold the promise to disproportionately impact our lives and in the process generate above-average returns.

Axilor Labs lens:

We believe traditional venture investing has quite an evolved framework for baking in Engineering risk, and the Science risk is best taken by public, academic or large institutes with massive R&D budget. But there remains a gap that is not fulfilled by either of the institutes. A stage where proof of science exists but proof of concept is a time and capital intensive effort. Where the milestones are primarily tech-oriented but it is critical to start engaging with early adopters. Where value created and market opportunity becomes conceivable but is not yet measurable.

At Axilor Labs, we are very bullish on DeepTech. We actively look for transdisciplinary talent breaking new grounds on areas that impact human health and wellness, directly (diagnostics, therapeutics) or indirectly (alt-protein, synbio etc). We are particularly motivated to solve challenges related to cancer, aging, nutrition, sustainability, and wellness through internal metabolism.

With Axilor Technology Fund II, we hope to accelerate our efforts to partner with innovators and scientists building such DeepTech solutions with the ambition of making real-life impact together.

Framework for qualifying Axilor Lab startups